Several planned speculative projects will cover two million square feet, but some wonder if too much logistics property might hit the market at the same time

Make no mistake: all the reports about speculative “big-box” projects dominating the Inland Empire’s industrial market are true.

Certainly no one who participated in this year’s NAIOP Inland chapter bus tour of industrial properties in Riverside and San Bernardino counties would dispute the claim.

About 275 people, most of them commercial brokers and developers, spent more than four hours earlier this month traversing the east or the west side of the Inland region, looking at industrial projects that are under construction or are available for sale or lease.

NAIOP’s bus tour gravitates to larger developments that are likely to attract more tenants and generate more revenue, but this year’s tour was noteworthy for the sheer size and volume of many of the projects inspected.

Sixty four projects were visited by the seven buses on the tour, 32 on each side of the two-county region. Almost all of them were speculative developments, and many of them have already installed infrastructure and tilted up concrete walls.

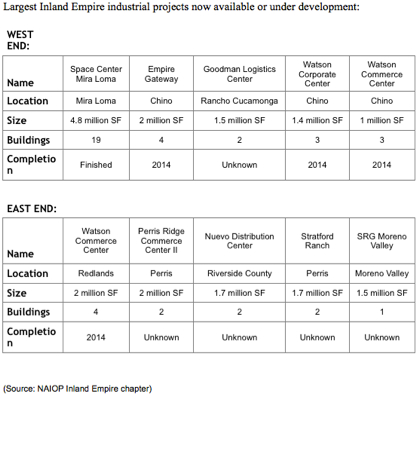

Two projects covered two million square feet or more, 18 topped one million square feet and 20 covered at least 500,000 square feet, the minimum size needed to be considered “big-box.” (See chart)

Roughly 60 million square feet of industrial development is currently being built in the Inland Empire, with much of that expected to hit the market next year, according to NAIOP, a national commercial real estate association.

Those are impressive statistics, especially three years after industrial development in the Inland region all but ground to a halt during height of the recession.

“I think everyone is impressed with the number of projects that are out there” said Robert Evans, executive director of NAIOP Inland Empire. “There’s a lot of activity compared with a few years ago.”

A lot of those projects are scheduled to go on the on the market next year, without signed tenants or anyone lined up to buy them.

That has at least one Inland broker wishing the Inland market had more smaller projects in the 200,000 to 400,000 square foot range under development. That would give the market some balance and improve its options with prospective tenants, said Ryan Velazquez, associate director with Cushman & Wakefield Ontario.

“You’ve got a lot of industrial coming online next year, and it seems like all of it is projects that are 500,000 square feet and larger,” said Velazquez, who served as a guide on one of the tour’s west end buses. “There aren’t a lot of tenants who can fill up that much space.”

Velasquez used the word “bubble” to describe what could happen if enough of those properties aren’t leased quickly: asking prices that rise at first, then drop precipitously as no demand emerges and the properties stay on the market.

“I don’t think we know how much demand is out there,” Velasquez said. “We’re seeing a few more properties in the 200,000 square foot range, and that’s good, but I would feel better if there were more of them.”

A burst industrial bubble could be a disaster for the Inland Empire, because the industrial market is so crucial to the region’s economy: it was the first economic sector in the two-county region to emerge from the recession, and it has created jobs while much of the rest of the local economy has lagged.

“We’re the biggest industrial market in the United States,” Velasquez said. “We’re like the office market in New York. It’s that important.”

Yes, but the local industrial market is not in danger of falling victim to a bubble, in part because the market is strong enough to withstand a few large vacant properties, said Milo Lipson, also a senior director with Cushman & Wakefield Ontario.

The Inland Empire industrial market covers about 430 million square feet, so what’s being developed now probably won’t have much of an impact either way, Lipson said

The market is also helped by a relatively low 6.2 percent vacancy rate.

“If none of this were to get absorbed I would be worried, but that won’t happen,” said Velasquez, who shared tour guide duties with Velazquez. “It doesn’t have to be absorbed immediately, so long as it’s absorbed. I think the saying ‘if you build it they will come’ applies here.”

The Inland industrial market is not overpriced, so it should be strong enough to withstand a rush of new product, said Mary Sullivan, a market analyst with the former Grubb & Ellis who now runs her own consulting firm.

“Our prices are still competitive against Los Angeles and Orange County, and as long as that doesn’t change we should be OK,” Sullivan said. “We might even have a price advantage over both of those markets. We also have some savvy developers in this market. They know what they’re doing.”

The amount of industrial development in the Inland region, particularly in the Perris-Moreno Valley market, is impressive, said Sullivan, who participated in the bus tour.

“I knew there was a lot, but when you see it up close you get a different perspective,” Sullivan said.

Bringing too much of any product on the market is always a risk, said Robert G. Caudill, director of Colliers International’s Orange County office specialty group, which covers the Inland Empire.

“You’re betting on two things, people coming into the market from the outside, and people who are already there expanding,” said Caudill, who said he watches the Inland industrial market because of its impact on the office market. “That is always a roll of the dice.”

Whether an industrial bubble will develop in the Inland region remains to be seen, but Caudill declined to rule it out.

“I will let the industrial experts figure that out,” he said.

IE Business Daily Business news for the Inland Empire.

IE Business Daily Business news for the Inland Empire.