By Edward L. Fixen

Entrepreneurs that want to be their own boss and manage their own business must face the question of should I buy an existing business or should I start one from scratch. Ultimately, the answer for each person depends on their particular circumstances and goals but this article identifies some key issues that should be considered.

Advantage to Start-Up

Generally, the biggest benefit of starting a business from scratch is lower initial investment is needed compared to buying an existing, profitable business. However, besides initial start-up costs, businesses generally require a significant amount of working capital to support the business and owner’s personal expenses while the business is growing and not profitable. Probably the most significant error most business start-ups make is under-estimating how much working and living capital is needed to survive the start-up phase before the business becomes profitable. Business plan pro-forma’s often show overly optimistic and unrealistic sales results that are not supported by the realities of acquiring customers and becoming profitable from a time or expense perspective.

Advantage to Buying Business

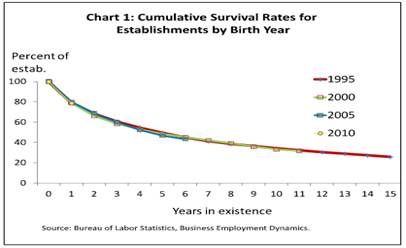

The risk of a start-up business failing is probably the single most compelling factor to buy an existing business since an existing businesses already have existing intangible assets that often take years for a start-up to acquire and establish. Those intangible assets include brand name, reputation, customers, employees, proven business processes and established income. The Bureau of Labor Statistics (see chart below) has estimated that 50% of start-up businesses survive the first five years, while approximately 33% will survive ten years. After ten years the survival rate begins to flatten and the risk of failure is greatly reduced. Therefore, there’s a lot to be said for buying a business that is ten years or older.

So while the initial investment to buy a profitable business is much higher compared to a start-up, the risk and return on investment when buying an established business is overall more favorable.

Besides risk, the International Business Brokers Association (IBBA) identified the following list of reasons to consider the purchase of an existing business rather that starting one:

- Proven Concept. Buying an established business is less risky – as a buyer you already know the process or concept works. Financing a purchase is often easier than securing funding for a start-up business for that very reason—the business has a track record. A bank will be able to look at the historical results for the business, not just rely on projections.

- Brand.You’re buying a brand name. The on-going benefits of any marketing or networking the prior owner has done will transfer to you. When you have an established name in the business community, it’s easier to place cold calls and attract new business than with an unproven start up. That’s an intangible benefit that’s difficult to put a price on.

- Relationships.With the purchase of an existing business, you will also be buying an existing customer base and vendor base that took years to build. It’s very common for the seller to stay on and transition with the business for a short time to transfer those relationships to the buyer.

- Focus. When you buy a business, you can start working immediately and focus on improving and growing the business immediately. The seller has already laid the foundation and taken care of the time-consuming, tedious start up work. Starting a new business means spending a lot of time and money on basic items like computers, telephones, furniture and policies that don’t directly generate cash flow.

- People.In an acquisition, one of the most valuable and important assets you’re buying is the people. It took the seller time to find those employees, develop them and assimilate them into the company culture. With the right team in place, just about anything is possible and you will have an easier time implementing growth strategies. Also, with trained people in place you will have more liberty to take vacation, spend time with family, or work on other business ventures. When start-up owners and independent contractors go on vacation, the business comes along.

- Cash flow.Typically, a sale is structured so you can cover the debt service, take a reasonable salary, and have some left over to take the business to the next level. Start-up owners, on the other hand, often “starve” at first. Some experts say start-ups aren’t expected to make money for the first three years.

In conclusion, the choice between buying a business or start-up can be a difficult one but risk and many other factors strongly lean toward buying when feasible.

Author: Mr. Fixen is a Certified Business Appraiser (CBA) and Certified Business Broker (CBB). Mr. Fixen is the President of BusinessQuest, a business valuation and M&A brokerage firm serving small & mid-size, privately-held businesses throughout Southern California and can be reached at ed@businessquestbrokers.com.

IE Business Daily Business news for the Inland Empire.

IE Business Daily Business news for the Inland Empire.