Last chance for local businesses to take advantage of thousands of dollars in tax savings

By Wendy Clements

The California Enterprise Zone Program will come to a close on December 31. Time is running out for local businesses to take advantage of this tax incentive program that offers thousands of dollars in tax credits to businesses for providing jobs to local workers and for investing in new equipment or property. Many local businesses are eligible—it’s just a matter of finding out how to qualify for theses tax credits.

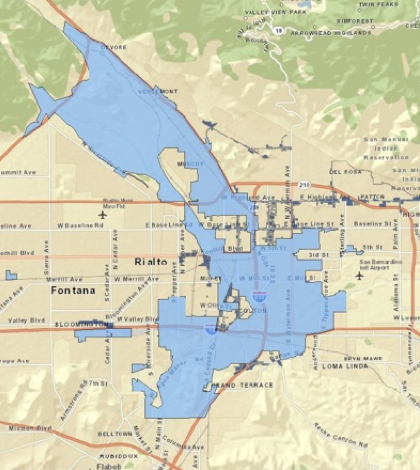

The Inland Empire is home to four enterprise zones, the largest being the San Bernardino Valley Enterprise Zone (SBVEZ), a 46-sqaure-mile area that includes the cities of Colton and San Bernardino and unincorporated portions of San Bernardino County. The other inland zones include Barstow, Hesperia and Coachella Valley.

There are approximately 8,000 San Bernardino and Colton businesses in the SBVEZ that are eligible for zone tax credits. Even though the tax credits won’t be available after December 31st all local business can act now to benefits from the enterprise zone program for years to come.

The SBVEZ’s most beneficial incentives are the Hiring Tax Credit and the Sales and Use Tax Credit. The hiring credit allows employers to accrue a tax deduction up to $37,440 for hiring and employing a worker who meets one of 11 qualifying categories. By using the credit, business essentially get back a portion of the wages paid to an employee that qualifies, lowering the overall cost to employ that person.

The sales and use credit allows companies to claim the taxes paid on certain equipment purchases that are pertinent to running or expanding their business. Eligible property includes machinery and machinery parts used to (1) manufacture or assemble a product, (2) produce renewable energy resources, (3) control air or water pollution or (4) process data and communicate.

Many local companies may already have employees that qualify them for the hiring tax credit, or recently made equipment purchases that are eligible for the sales and use credit. If there are expansion plans on the horizon, businesses should also look into using these credits to hire new workers before January, and make any planned equipment purchases now, rather than later.

Any qualified new hires or equipment purchases made and put into service before the December deadline may be applied, and all credits earned and unused may be carried forward for 10 years. Businesses also have until Dec. 31, 2014 to file their hiring tax credit vouchers, a concession provide by the recent passage of Assembly Bill 106.

As the enterprise zone deadline nears, the SBVEZ is offering help to businesses that want to find out how the program in the next two months to save money for the next few years.

On November 5 at 8 a.m., an EZ 101 workshop will be held at the Norton Regional Event Center – 1601 E. 3rd Street, San Bernardino, CA 92408 – to provide further detail about the zone’s tax credits and give businesses an opportunity to meet directly with EZ experts.

One-on-one appointments with SBVEZ representatives are available anytime by calling (909) 382-4538 or emailing info@sbvez.com. Businesses can also visitwww.SBVEZ.com to learn more about the program, upcoming events and to see if their business is located in the zone by viewing the zone map.

There is no time to lose, and only savings to gain, so contact the SBVEZ for more information today.

Wendy Clements is zone manager of the SBVEZ.

IE Business Daily Business news for the Inland Empire.

IE Business Daily Business news for the Inland Empire.