By Edward L. Fixen

It’s normal for business owners to wonder what their business is worth. The actual amount that a particular business sells for depends on many factors unique to that individual business such as historical stability, profitability, growth, industry, customer base, etc. Nonetheless, it is always a good idea to keep an eye on trends and general benchmarks regarding businesses valuation multiples in your industry.

A common market-based valuation multiple reviewed in this article is Sell Price as a multiple of EBITDA (Earnings before Interest, Taxes, Depreciation & Amortization). EBITDA is a commonly used financial metric to measure the earnings of a business. For example, a retail business with annual EBITDA of $1 million with a price-to-EBITDA multiple of 2.50 would sell for $2.5 million.

Other common valuation multiples are Price as a multiple of Revenue or Price as a multiple of Discretionary Earnings. Discretionary earnings are a common measure used to value the sale of small, privately-held companies where the buyer is essentially buying a job. Discretionary earnings is simply EBITDA plus owner compensation and other owner related benefits that are expensed through the business. Data discussed in this article is limited to valuation multiples based on Price-to-EBITDA.

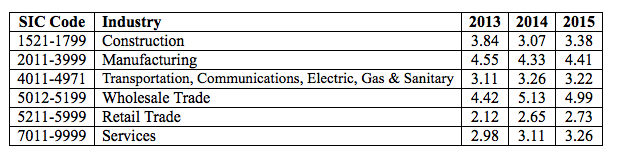

The following table shows median values for market-based business valuation multiples for the sale of privately-held businesses by industry for the last three years. The results summarized below are derived from the actual sale price of privately-held businesses purchased by private buyers (i.e., excludes acquisitions by publicly traded companies).

Median Market-Based Valuation Multiples (PRICE/EBITDA)

By Industry For All Sales Ranges*

* Source – Pratt’s Stats Private Deal Update Newsletter 2nd Quarter 2016

There are several interesting observations that can be drawn from this data. Manufacturing and wholesale businesses generally sell for a higher valuation multiple compared to the other industries. The retail trade industry has consistently sold for a lower valuation multiple compared to other industries.

With respect to trends, the median EBITDA valuation multiple for the retail industry is the only industry that has consistently increased over the past three years, increasing from 2.12 in 2013 to 2.73 in 2015. Valuation multiples for four out of the six industries had year-over-year increases while transportation and wholesale had relatively small decreases. The data in the table above would be even more meaningful if it were further stratified or categorized based on annual revenue because in general, businesses with sales over $5 million sell for a higher valuation multiple than businesses with annual sales of $1 million or less.

However, buyers and sellers beware! Any statistic, including median valuation multiples, should be viewed as a statistical benchmark or reference point but nothing more. For example, the fact that the median manufacturing business sold for 4.22 times EBITDA in 2014 only means that 50% of manufacturing businesses sold for less and 50% sold for more. The actual value of any business will be highly dependent on the unique characteristics of that business and will more than likely either be higher or lower than the median valuation multiple. By how much depends on the how the company compares to its industry in terms of profitability, growth and many other factors. A comprehensive business valuation by a qualified business appraiser would be necessary to determine the actual fair market value of a specific business.

Author: Mr. Fixen is a Certified Business Appraiser (CBA) and Certified Business Broker (CBB). Mr. Fixen is the President of BusinessQuest, a business valuation and M&A brokerage firm serving small & mid size, privately-held businesses throughout California and can be found at www.BusinessQuestInc.com.

IE Business Daily Business news for the Inland Empire.

IE Business Daily Business news for the Inland Empire.