By Edward L. Fixen

Almost all business owners wonder what their business is worth. The actual amount that a particular business sells for depends on many factors unique to that individual business such as historical stability, profitability, growth, industry, customer base, etc. However, it is always a good idea to keep an eye on trends and general benchmarks regarding businesses valuation multiples in your industry.

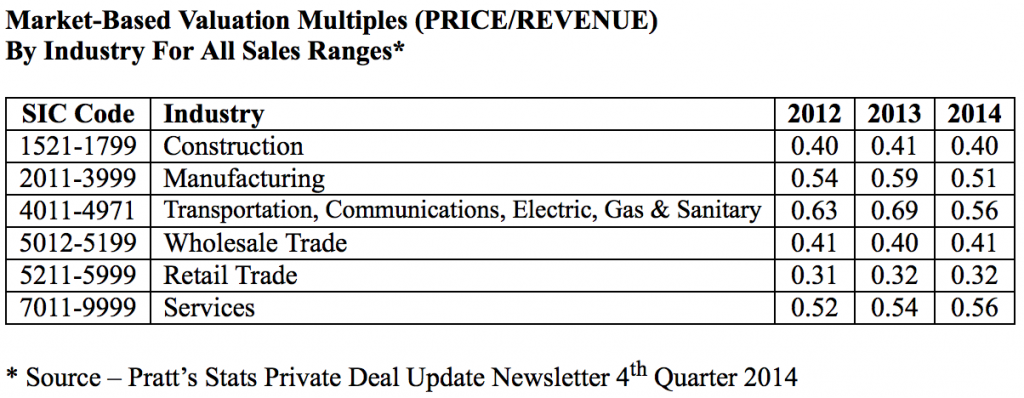

The following table shows median values for market-based business valuation multiples for the sale of privately-held businesses by industry for the last three years. A common market-based valuation multiple as shown in this table is Sell Price as a multiple of Revenue. For example, a business with annual revenue of $2 million with a price-to-revenue multiple of 0.50 would sell for $1 million.

Another common valuation multiple not shown in the table below is Sell Price as a multiple of Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA). Market-based valuation multiples and the results summarized below are derived from the actual sale price of privately-held businesses purchased by private buyers (i.e., excludes acquisitions by publicly traded companies) over the past 3 years.

There are several interesting observations that can be drawn from this data. Manufacturing, transportation and service businesses generally sell for a higher value compared to the other industries. The retail trade industry has consistently sold for a lower value compared to other industries.

With respect to trends, the median valuation multiple for the service industry is the only industry that has consistently increased over the past three years. Construction, wholesale and retail valuation multiple have been very steady over the past three year years. Manufacturing and transportation increased in 2013 followed by a decrease in 2014.

Any statistic, including median valuation multiples, should be viewed as a statistical benchmark or guideline but nothing more. The fact that the median wholesale business sold for 0.41 times revenue in 2014 only means that 50% of wholesale businesses sold for less and 50% sold for more. The data in the table above would be even more meaningful if it were stratified or categorized based on annual revenue/sales because in general, businesses with sales over $5 million sell for a higher valuation multiple than businesses with annual sales of $1 million or less.

Author: Mr. Fixen is a Certified Business Appraiser (CBA) and Certified Business Broker (CBB). Mr. Fixen is the President of BusinessQuest, a business valuation and M&A brokerage firm serving small & mid size, privately-held businesses throughout California and can be found at www.BusinessQuestBrokers.com.

IE Business Daily Business news for the Inland Empire.

IE Business Daily Business news for the Inland Empire.